ACH Transfers for Businesses: Faster, Cheaper & Automated Payments

What is ACH Transfer

ACH bank transfer is a type of electronic transfer of money from one bank to another that uses the ACH (automated clearing house) network. It is utilized by banks, credit unions, and other financial institutions to send money at specific times of day by bundling multiple payments or direct deposits.

NACHA (National Automated Clearing House Association) regulates and administers the ACH network. It is an independent organization owned by a large group of banks, credit unions and payment processor companies. ACH transfers provide a direct money transfer mechanism between accounts at different banks, eliminating the need for cheques, wires, credit cards, or cash.

ACH transfers mainly include but are not limited to the following:

- External fund transfers

- Person-to-person payments

- Bill payments

- Direct salary deposits from employers

- Government benefits

Apart from banks, instant ACH transfer apps (which enable Ach transfers within a few minutes to few hours) like PayPal and Venmo utilize the NACHA ACH network for money transfers.

What this blog covers:

- What ACH transfer is and how it works across banks and institutions.

- Types of ACH transfers: ACH credits vs debits and their use-cases.

- Comparison: ACH transfers vs wire transfers in terms of speed, cost, and settlement.

- Processing timelines, batch settlement, and how Same-Day/Instant ACH changes the game.

- Benefits of ACH transfers: cost-effectiveness, convenience, security.

- Key challenges in ACH transfers: timing lags, reconciliation issues, fraud risk.

- How to optimise ACH transfer workflows and improve reconciliation.

- How Osfin automates ACH transfer reconciliation and supports financial operations.

- Frequently Asked Questions on ACH Transfer

How Do ACH Transfers Work?

ACH looks instant on the surface, but underneath it runs on a predictable rhythm.

Banks coordinate, batch, and settle behind the scenes before money ever hits an account.

Here are the five stages that make the whole thing work.

Step 1: You authorize the payment and your bank prepares it

You give your bank the routing number, account number, amount, and date. Then, your bank checks the authorization and packages your request for ACH processing.

Step 2: Your bank batches your payment with others into an ACH file

Instead of sending payments one by one, your bank groups thousands of transfers into a single standardized ACH file that the network can read.

Step 3: The file goes to an ACH Operator for sorting

The operator (FedACH or The Clearing House) validates the file, sorts payments by destination bank, and calculates how much each bank owes or should receive.

Step 4: The Federal Reserve moves money between banks

Using the net totals, the Fed debits the sender’s bank and credits the receiver’s bank. This is the actual movement of funds beneath the surface.

Step 5: The receiving bank posts the payment to the customer.

The recipient’s bank applies the incoming amount to their account during its posting windows, and the money becomes available based on that bank’s timing rules.

{{banner1}}

Types of ACH transfers

ACH transfers are of two main types: credit and debit. Here's a detailed discussion:

1. ACH Credits

An ACH credit transfer is where you receive money via the ACH network. To receive money via ACH, you are required to provide the following:

- Bank name

- Routing number

- Account number

When the ACH payment is sent and processed, the money will be credited to your account. ACH credit is popular for:

- Direct deposits, such as employee paychecks, bonuses, reimbursements and benefits.

- Tax and other refunds

- Money transfers from platforms like Venmo and Zelle.

- Social security, unemployment and other government benefits

2. ACH Debits

When you send money to a bank account, you utilize the ACH debit transfer. To complete such a transfer, you require the following:

- Recipient account number and routing number

- Patient's account type (checking or savings)

Apart from this, you also need to provide information on whether the recipient's account is an individual or business account.

To make an ACH debit transfer, you need to enter the above information into a payment platform, such as an instant ACH transfer app like Venmo or Zelle. Upon successful completion, the money will be debited from your account.

ACH vs. Wire Transfer

ACH vs Other Payment Methods” (cards, cash apps, SWIFT, SEPA, BACS)

ACH is a batch-based system that moves money quietly in the background of the U.S. economy. It’s built for routine transfers, steady volumes, and low costs, which makes it the backbone for payroll, bills, and business payments.

But other rails solve different problems, from real-time card authorizations to cross-border bank messaging.

Here’s how ACH compares to the major payment methods.

Key Takeaways

- ACH is the cheapest option, but not the fastest. It’s Great for predictable transfers, not urgent ones.

- Cards trade speed for cost and disputes. Instant approvals, but expensive fees and heavy chargeback exposure for merchants.

- Cash apps feel instant because the “instant” part happens inside the app. The real bank transfer behind the scenes still rides ACH or push-to-card rails.

How Long Do ACH Transfers Take?

ACH transfers typically take a few hours to three business days, depending on the time of day the transfer is initiated and whether instant ACH is used.

ACH credit and debit have different timelines as follows:

- ACH Credit Transfer: ACH credits can be processed and delivered on the same day or within one to two business days, depending on the financial institutions.

- ACH Debit Transfer: This must be processed by the next business day.

Same-day ACH payments process the transfer on the same day but with a higher transfer fee.

How Does Instant ACH Work?

ACH transfers happen in batches at specified times of the day. Hence, the settlement time is usually in days. However, some third-party payment platforms can facilitate instant ACH transfers. Before understanding instant ACH, let's clarify some financial terms:

- ODFI (Originating Depository Financial Institution): Financial institution that initiates the ACH transfer.

- RDFI (Receiving Depository Financial Institution): Financial institution that receives the payment.

In instant ACH, the amount is made available to the recipient before the RDFI processes it. This occurs because the third-party instant ACH app covers the amount. The fund transfer is technically finalized later via the formal ACH process. A tradeoff is that the transaction limit for instant ACH is typically lower than that for traditional ACH.

Why Businesses Use Instant ACH

Business use Instant ACH, because it gives them the speed they need without the high fees of cards or wires. It turns a normally slow, batch-based process into a near-real-time way to move money, which makes day-to-day operations run smoother.

- Faster access to cash: Funds clear in minutes or hours instead of days, which helps payouts, refunds, and account transfers land when they’re actually needed.

- More predictable cash flow: Quick settlement tightens the gap between when money moves and when it can be used, making forecasting and liquidity management easier.

- Lower cost than cards: Businesses keep ACH’s low-fee structure while avoiding the interchange, chargeback, and processing costs that come with card payments.

- Better experience for customers and partners: People get paid, refunded, or funded quickly, which lowers support pressure and builds trust.

Instant ACH offers that sweet spot for businesses that want ACH pricing with real-time convenience.

What Are the Potential Challenges of Instant ACH?

Some potential challenges of instant ACH include:

1. Lower Transfer Amount: The transaction value for instant ACH is significantly limited compared to traditional ACH transfers. This is due to the third-party provider covering the transfer amount.

2. Fraud and Error Risk: Faster processing times inevitably lead to increased risk of fraud or errors, as there's less time to detect mistakes and reverse transactions.

3. Security and Compliance Requirement: Instant ACH transfers have stricter security and compliance requirements. When implementing instant ACH, you may need to enforce more secure authentication, enhanced security measures, and additional regulatory reporting requirements.

4. Higher Transaction Fees: Instant ACH is typically more expensive for high-volume, low-value transactions and hence requires adequate management to avoid offsetting operational gains.

5. Limited Network Participation: Not all financial institutions support instant ACH and may process transfers at standard ACH speeds.

{{banner2}}

How Much Is an ACH Transfer Fee?

Here's a fee breakdown for different types of ACH transfers:

- ACH Credit Transfer: Typically, $3 for sending money to your bank account at a different bank. Receiving external funds is free.

- ACH Debit Transfer: For debit transfers, such as debit deposits and payroll payments, there are no fees. Fees might be applicable for expedited payments.

For person-person payments via third-party apps, the transaction fee is usually applied depending upon the platform and payment method.

How to Make ACH Transfers More Quickly?

The following techniques can help you make ACH transfer more quickly:

1. Initiate Transfer Before Cutoff Time

Financial institutions typically have a cutoff time for initiating transfer processing. If you submit a transfer request after the bank or financial institution's cutoff, processing will be initiated on the next business day.

2. Upgrade Delivery Speed

Some financial institutions offer same-day or next-day transfers, although these services typically incur a fee.

3. Use Instant ACH Apps

Instant ACH apps enable ACH transfers within a few minutes to a few hours, typically at a fee. They achieve this through a combination of continuous processing (as opposed to batch processing), pre-funding, provisional credits, and interbank agreements.

Advantages and Disadvantages of ACH Transfers

The benefits of ACH transfers are:

- Convenience: ACH transfers eliminate the inconvenience of writing, depositing and receiving cheques.

- Security: ACH transfers are private and secure. The money doesn't get lost or stolen in the mail.

- Low-cost: ACH transfers are typically free or incur a fee of less than $1 for standard transactions.

- Speed: Same-day and instant ACH-enabled transfers occur within a few minutes to a few hours.

The challenges associated with ACH transfers are:

- Transfer Limit: Compared to wire transfers, ACH transfers have a lower transfer limit. Instant ACH limits can be even lower than standard ACH. For example, P2P payment apps like Zelle can have transfer limits as low as $500.

- Slow Speed: Standard ACH can take anywhere from one to three business days.

- Reversibility: When you make a standard ACH money transfer online, it is usually reversible. While this is beneficial for customers, it presents a drawback for businesses that accept ACH transfer payments.

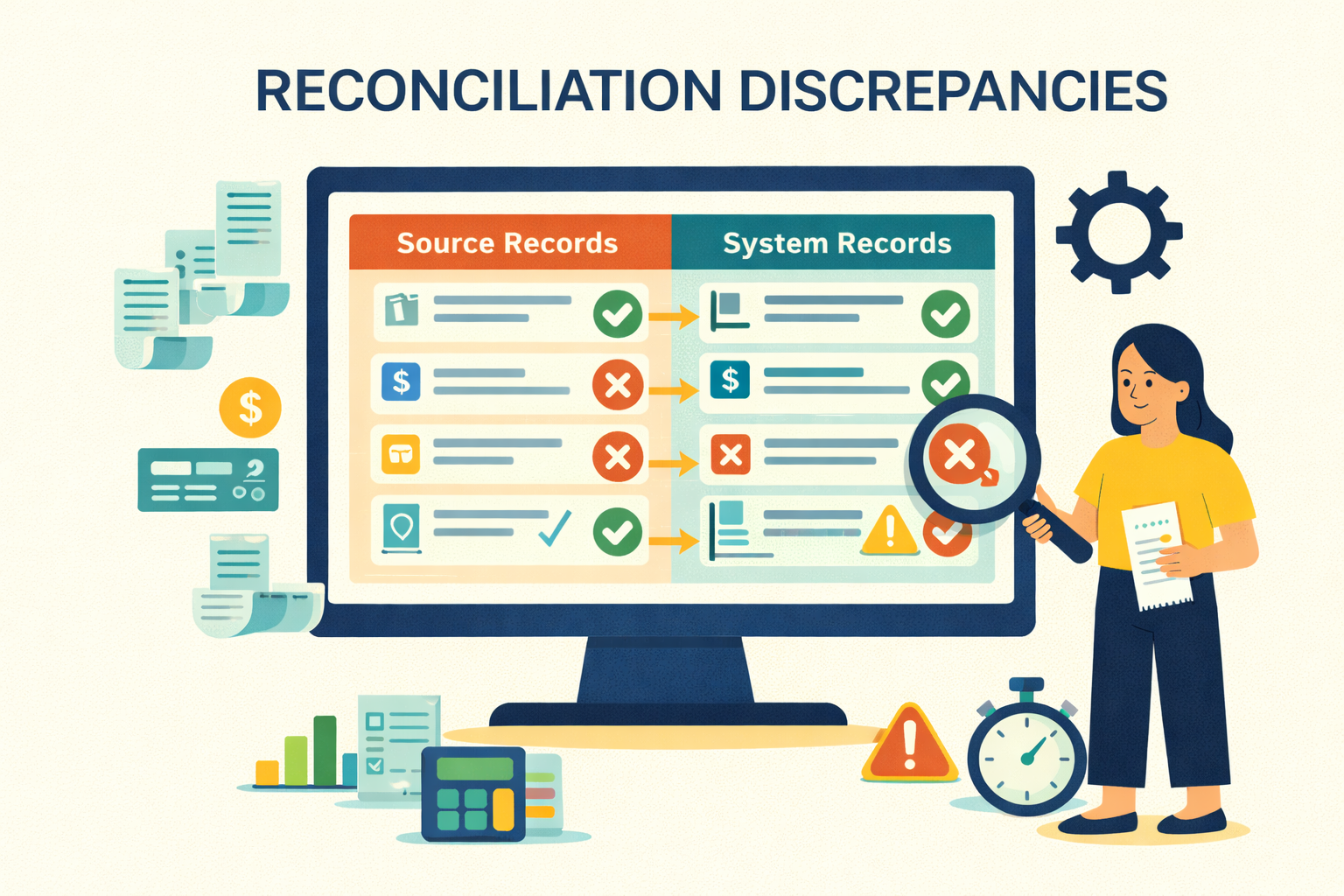

- Reconciliation: ACH reconciliation is challenging because settlements are often delayed, taking one to three days, and payments lack real-time confirmation, resulting in timing mismatches. High transaction volumes and inconsistent data formats increase errors, and manual processes amplify delays and risks. Incorrect reconciliation of ACH transactions can lead to serious issues for your business, such as missed or duplicated payments, can distort cash flow projections, delay vendor settlements, and create accounting discrepancies.

Conclusion

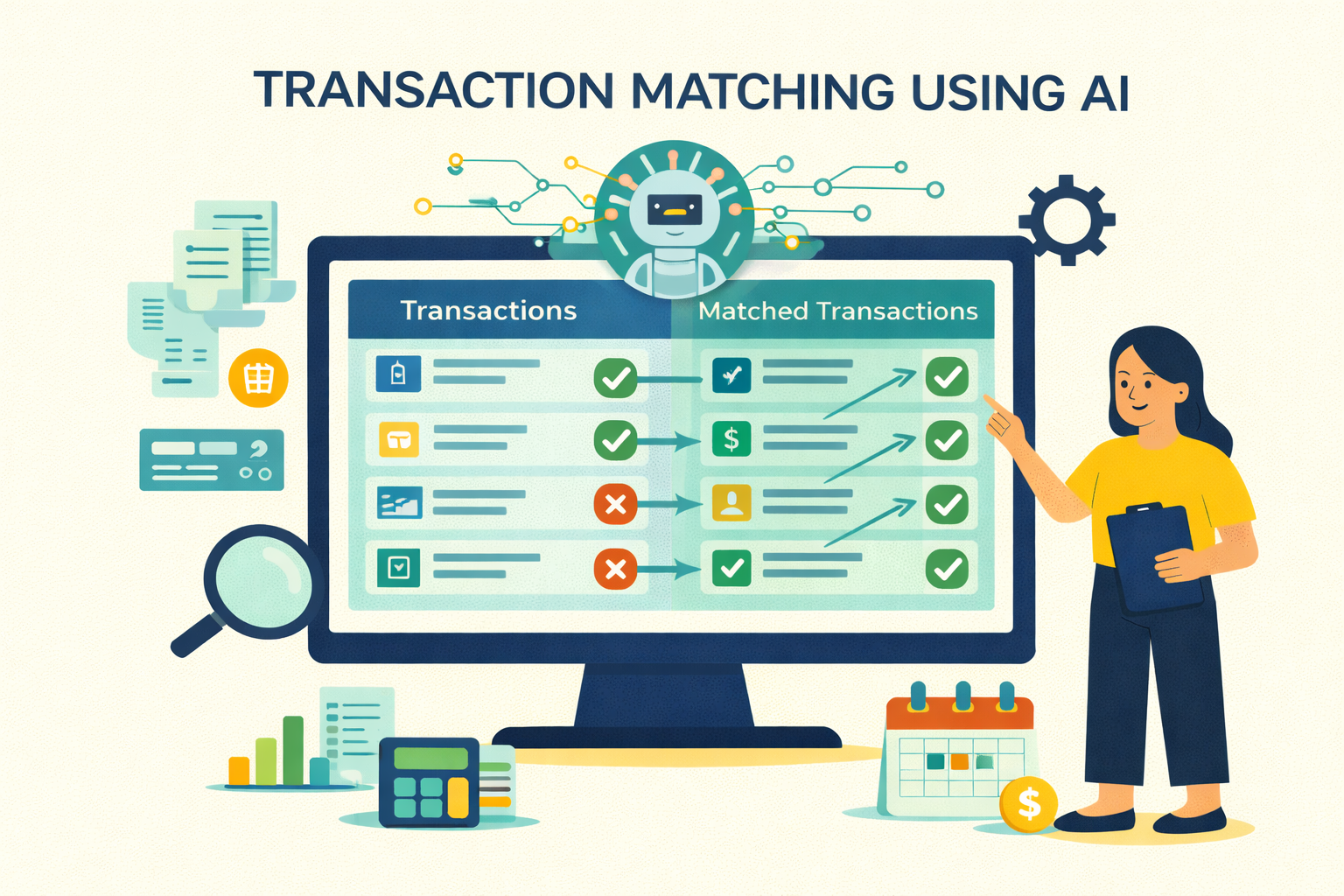

ACH transfers are fast and cost-effective, but as volumes grow, so do the challenges of tracking and reconciliation. Osfin simplifies this by automating the entire process, from real-time payment tracking to auto-matching transactions and flagging errors before they become problems. Here’s how Osfin can make ACH reconciliation effortless, error free, and audit-ready:

Osfin simplifies financial data handling with over 170 integrations that import data from any format. It filters poor-quality data and spots duplicates right at the start. Its smart reconciliation engine matches complex transactions quickly, processing up to 30 million records in 15 minutes, and handles payment gateway reports with full tax and fee breakdowns. Unmatched transactions are flagged with clear reasons, routed to the right team, and tracked in real time through live dashboards. Osfin also delivers audit-ready reports and secures data with strong encryption, role-based access, and compliance with standards such as SOC 2, PCI DSS, ISO 27001, and GDPR.

With Osfin, you can manage ACH payments confidently, stay compliant, and focus your energies more on growing your business, not chasing transactions.

{{banner3}}

FAQs on ACH Transfer

1. What is the maximum ACH transfer limit?

ACH transfer limits can be as high as $1 Million per day. The actual limits depend upon the financial institution and the type of ACH.

2. What are the drawbacks of ACH?

Some drawbacks of ACH are long processing times (for standard ACH) and lower transfer limits compared to wire transfers.

3. Can ACH payments be blocked?

A business can block ACH debits, which prevents electronic debits from being processed. It is typically used in order to avoid fraud.

4. Are ACH transfers secure?

ACH transfers are federally regulated and highly secure. The risk of fraud in standard ACH transfers is typically lower than in wire transfers.

5. How long does an ACH transfer take on weekends or holidays?

ACH only moves on business days, so anything submitted on a weekend or holiday waits until the next banking day to process. The transfer then follows the normal one-to-three-day settlement timeline.

6. Are ACH transfers available internationally?

Not directly. ACH is a U.S. domestic system. Some banks offer “international ACH” through intermediaries, but those transfers rely on separate cross-border rails and typically take several days with higher fees.