What are SOX Controls and Why They Matter for Audit Readiness?

In today’s complex financial environment where internal fraud, misstatements, and data breaches are front-page news, SOX controls come in for the rescue.

As per the Sarbanes-Oxley Act of 2002, SOX controls apply to each publicly traded company in the U.S. They work to guarantee financial information accuracy and reporting reliability. When dealing with regulatory and compliance requirements, the right SOX control implementation can set you up for financial success.

Understanding what SOX controls are, how they function, and examples of SOX controls, is the first step toward this success. In this article, we’ll explore how, and discuss how you can streamline your process with automation tools like Osfin.

What this blog covers:

- What SOX controls are and why they’re important

- Key types of SOX controls and compliance requirements

- Steps to design, test, and maintain effective controls

- Common challenges and best practices for compliance

- How automation tools like Osfin simplify SOX control monitoring

- Frequently Asked Questions on SOX Control

What Are SOX Controls?

SOX controls are the internal guardrails that keep a public company’s financial reporting honest. These rules and checkpoints are guided by the compliance requirements of the Sarbanes-Oxley Act of 2002, ensuring every number in a report is real, traceable, and compliant. Eventually, SOX controls prevent fraud, catch mistakes early, and prove reporting accuracy.

Designed to align with the Committee of Sponsoring Organizations (COSO) model, SOX controls will ultimately protect investor interest and improve your corporate transparency.

What is SOX compliance?

SOX compliance means that a publicly traded company in the U.S. has put in place, maintained, and demonstrated effective internal controls and accurate financial reporting, as required by the Sarbanes-Oxley Act of 2002. It’s about proving that the books are honest, leadership stands behind them, and investors can trust the numbers.

Why are SOX Controls Important in Corporate Governance?

The Sarbanes-Oxley Act was passed following infamous corporate accounting scandals in 2001. The act mandated a system of controls that overhauled the financial reporting and auditing processes of public companies.

SOX controls were outlined to protect the integrity of financial reporting and enforce greater accountability across business processes.

Since they scope financial reporting, internal controls, and all associated documentation, SOX controls hold extensive power over corporate governance. They introduced independent auditing procedures, production of financial reporting through certification systems, increased the required amount of financial data to be disclosed, and established extensive codes of ethics and conduct. Organizations were able to reduce the likelihood of financial fraud and inaccurate disclosures.

The consequence is increased corporate responsibility, with complete transparency, accountability, and ethics, in today’s era of corporate governance.

SOX: Key Sections Explain (302, 404, 906)

These three sections are the spine of SOX. 302 makes leaders own the numbers. 404 makes the company prove the controls work. 906 adds teeth if someone lies. Let’s break them down clean.

1. Section 302

Section 302 says that the CEO and CFO must personally certify the financial reports they file. They can’t pass this accountability to their team members. They can’t get away with “to the best of my knowledge.” It means they claim responsibility for any discrepancies.

It clearly means they acknowledge

- He and concerned members reviewed the report.

- The report is true and doesn’t hide material facts.

- The organization has internal controls in place to keep it that way.

- If the organization found control weaknesses or fraud, we disclosed it.

So 302 is about quarterly accountability. It forces leadership to pay attention to control breakdowns, access issues, and bad reconciliations. Because once they sign, they can be held accountable in the event of an incident.

2. Section 404

Section 404 is all about proving your controls work. Organizations can’t just get away with documenting and proving controls exist, but they also have to test them for their actual, real-world performance.

There are primarily two parts to it:

- 404(a), which states that management must assess the effectiveness of internal control over financial reporting (ICFR), usually using COSO.

- 404(b), which states that for larger issuers, an external auditor must attest to that assessment.

This is where process documentation, reconciliations, approvals, change management, role-based access, and monitoring get tested. If controls are weak or not operating all year, it shows up as a deficiency or even a material weakness. And that goes public.

3. Section 906

Section 906 establishes consequences. It says that if a CEO or CFO knowingly or willfully certifies a false report, they can face criminal penalties. These penalties go beyond just SEC fines; they bring in the possibility of personal liability and jail time.

Types of SOX Controls

SOX and internal controls are tightly connected, but the act does not specify precise classification standards. These controls can be categorized by domain and function.

To make it easier to understand how these control types differ and where they overlap, here’s a quick visual comparison:

Now that we know how controls fair against each other, it’s time to dive deeper into SOX controls.

Domain-Based Controls

1. Financial Controls

These ensure the accuracy and completeness of financial reporting. They address how transactions are recorded, approved, and reviewed. Journal entry approvals, account reconciliations, and segregation of duties are common examples.

2. IT Controls

IT controls protect the systems and data that support financial operations for an organization. With strong IT controls, you face a reduced risk of unauthorized access, system changes, or data loss. This IT-level control feeds into the stability of financial reporting. Some examples include role-based access to critical data, change management, regular data backups.

Function-Based Controls

1. Preventive Controls

Preventive controls stop issues before they happen. Access restrictions and pre-approved workflows are examples.

2. Detective Controls

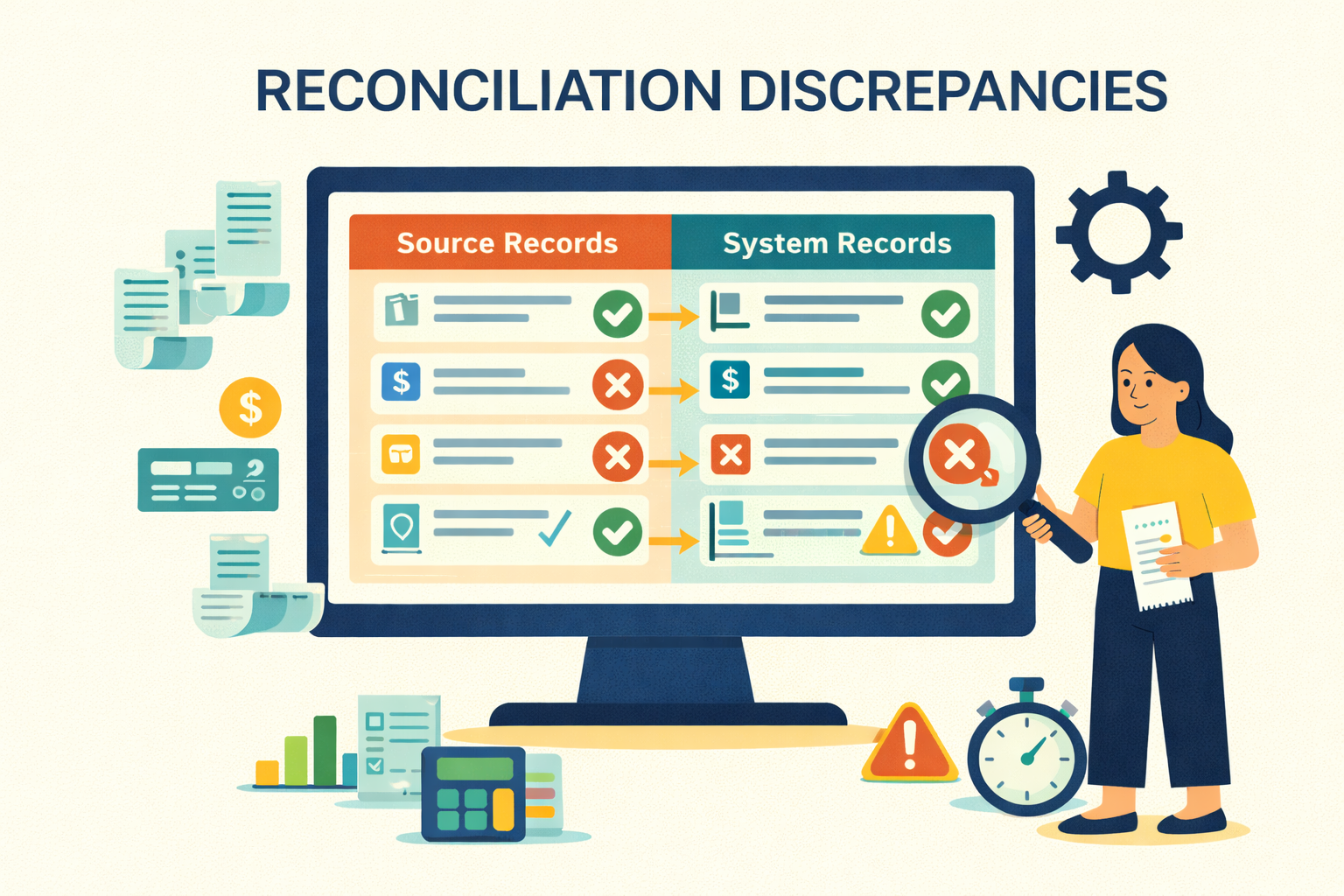

On the other hand, detective controls are used to identify issues after they occur. Examples include exception reports, audit trails and automated reconciliation workflows, which identify mismatches between internal and external sets of data.

3. Corrective Controls

After identification of issues, resolutions are enabled by proper corrective controls. Examples are reversing incorrect entries, removing unauthorized access, implementing fixes post-audit.

A SOX controls list also includes manual, automated, hard, soft, key and secondary controls, which similarly operate in different situations and produce different outcomes. The endgame is to retain the financial accuracy and record legitimacy for any organization.

{{banner1}}

Common Examples of SOX Controls

Interestingly, many organizations already have SOX-relevant controls in place. Below is a concise SOX controls list:

- Multi-factor authentication (MFA) for controlled, predetermined access

- Daily reconciliations of key accounts, to detect financial discrepancies early

- System logs and activity monitoring to track changes to financial data

- Role-based access controls (RBAC) in enterprise applications to enforce segregation of duties

These examples of SOX controls strengthen internal control over financial reporting. Mitigating risks and enhancing transparency are ultimate targets.

SOX Control Testing: Overview and Best Practices

SOX control testing ensures that your internal controls over financial reporting are both well-designed and well-executed. They are performed by management, and internal and external auditing teams. Control testing generally involves two complementary parts:

- Design Effectiveness Testing

Here, testers assess whether the control in question addresses the financial reporting risk it was designed for.

- Operating Effectiveness Testing

The next logical test assesses whether the control works reliably over time. Reviewing approvals, logs, or exception reports can help.

Along with the testing, here are best practices that can help streamline the process:

1. Maintain documentation

The most important practice is maintaining comprehensive documentation of the testing process. Regularly review and update documentation: make sure that it reflects your actual financial processes.

2. Associate each control with a specific risk

This helps ensure that every control has a clear purpose. It makes it easier to justify its inclusion (or removal) in the overall compliance framework.

3. Automate

Use automation tools for scaling data, monitor control execution continuously, and reduce the risk of manual errors. Tools like Osfin are designed to achieve this end goal.

4. Ensure tester independence

To avoid potential conflicts of interest, independence of testers should be ensured. It will directly impact the credibility of testing results.

When done systematically, the benefits of SOX testing are two-fold: It supports regulatory compliance and improves confidence in financial reporting of your organization. Next, we’ll explore a one-stop solution for your SOX control management needs.

{{banner1.1}}

How Osfin Supports SOX Control Management

SOX compliance is fundamentally about building trust, resilience, and agility into your internal control environment. With its many moving parts, an automation platform can greatly simplify the process for your organization, in order to achieve this financial compliance.

Osfin, a reconciliation engine with automated control monitoring, SOX workflows, end-to-end audit trails, and expert support, is the right companion to your SOX control management needs.

Here’s how Osfin helps: a unified data ingestion layer brings together input data into a single platform. Access rights and segregation of duties (SoD) are analyzed automatically to flag violations and ensure quick resolution.

Pre-built SOX workflows and end-to-end traceability create audit trails for every internal control test. Built for scale, Osfin supports your SOX control management requirements and builds a strong foundation for reconciliation, even as financial data scales.

To further strengthen this management, it’s important to regularly evaluate your chosen controls. We’ll cover these in a short checklist in the next section.

SOX Controls Checklist for Finance and IT

With your SOX controls in place, use this checklist to see how you're faring:

Finance Controls

- Reconciliation workflows: Perform regular reconciliations to stay on top of your financial status.

- Approval hierarchies: Implement multi-level approvals for high-risk financial activities and transactions.

- Journal entry validation: Validate manual entries through documentation and independent review.

- Periodic financial reporting: Generate and review financial reports on a monthly, quarterly, and annual basis.

- Segregation of duties (SoD): Check for clear separation between transaction initiation, approval, and recording processes.

IT Controls

- User provisioning & deprovisioning: Implement a controlled process for granting, modifying, and revoking data access

- Access logs and audits : Monitor user activity and access to sensitive systems.

- Change management controls: Follow formal procedures for system changes, including testing and approval.

- Backup and disaster recovery: Maintain regular data backups and test recovery plans.

- Role-based access control: Grant access based on job roles and responsibilities.

{{banner2}}

Implementation and Compliance Challenges

Despite their importance, SOX controls can be difficult to implement and maintain. There are some common challenges that can be expected here:

Legacy systems

Older platforms may not support access logging, audit trails, or change tracking by default. Modern reconciliation-first tools like Osfin are optimal choices.

Manual processes, workflows

Relying on manual processes understandably increases the risk of errors and oversight. When it comes to financial data reconciliation, a lack of automation can hamper your organization’s efficiency.

Decentralized data sources

When financial and operational data are disconnected, it becomes difficult to monitor and validate controls in real-time.

Repeated audit fatigue

Teams can become overwhelmed by repeated testing cycles, documentation requirements, and frequent manual reviews.

Common SOX Failure Modes & How to Avoid Them

Even the best-run public companies trip over the same SOX landmines. The ones hiding in PCAOB findings and SEC comment letters year after year. The same control failures show up in audit reports; different companies, same mistakes.

Learn these patterns once, and you’ll never waste another cycle fixing the fix.

1. Bad Design, Good Intentions

Controls get built to please auditors, not to prevent risk. “Review monthly revenue” isn’t a control if no one defines how or what to review.

To fix it, redesign every control around precision and population. Spell out inputs, thresholds, and evidence. Review design before you automate it — bad logic in code just fails faster.

2. Dangling ITGC

Access and change-management controls exist on paper but not in production. Orphaned accounts linger; developers patch live systems.

To fix it, automate provisioning, enforce segregation of duties at the role level, and audit logs monthly. Assume one missed deprovisioning equals one future finding.

3. Scope Drift

It’s one of the most common mistakes. It’s also the one that’s most avoidable. Teams either over-scope (500 controls, no bandwidth) or under-scope (critical gaps). Both end in deficiencies.

To avoid it, tie every control to a financial-statement assertion.

4. “Fixed” but not tested

Remediation plans look neat in PowerPoint but never season. To avoid it getting flagged by the auditor, treat remediation like a new control rollout, prove design and operating effectiveness over at least one full cycle.

5. Documentation drift

Processes evolve, paperwork doesn’t. Auditors test what’s there, not what’s written. To fix losing audits to documentation drift, conduct quarterly walkthroughs. Mandate control owners to certify that their procedures always match the reality. Maintain version history with every change.

Best Practices for Maintaining SOX Compliance

Maintaining SOX compliance requires sustained effort. Embedding the following best practices into your finance and IT workflows can help you achieve just that:

Conduct annual risk assessments

Reevaluate your processes regularly, ideally each year, to ensure your control framework addresses new risks and changes.

Automate recurring control testing

Use automation to handle high-frequency control tests, to minimize manual errors and save audit time.

Centralize documentation

Keep all control evidence and related documentation in a centralized system. This not only supports transparency, but also simplifies reviews by internal and external auditors.

Provide continuous training

Equip your teams with regular training sessions on SOX requirements, new tools, and process updates. Awareness is key.

Perform mock audits

A good idea is to simulate audits at least once a year. This validates control effectiveness, and prepares your teams for real-world audit pressure.

{{banner2.1}}

Building Resilient SOX Controls with Osfin

The meaning of SOX controls goes beyond compliance. With the complete picture of SOX controls, benefits, and challenges in mind, comes the time for providing a centralized solution to your management needs. As financial data and scrutiny increases, your control management needs to keep pace. With Osfin, you streamline reconciliation and other financial processes through audit trailing, visibility, error detection and resolution pipelines.

Here’s a more in-depth overview:

- With 170+ pre-built connectors, Osfin integrates seamlessly with ERPs, processors, and banking systems.

- It supports all major file formats, including MT940, ISO 20022, CSV, JSON, and XML.

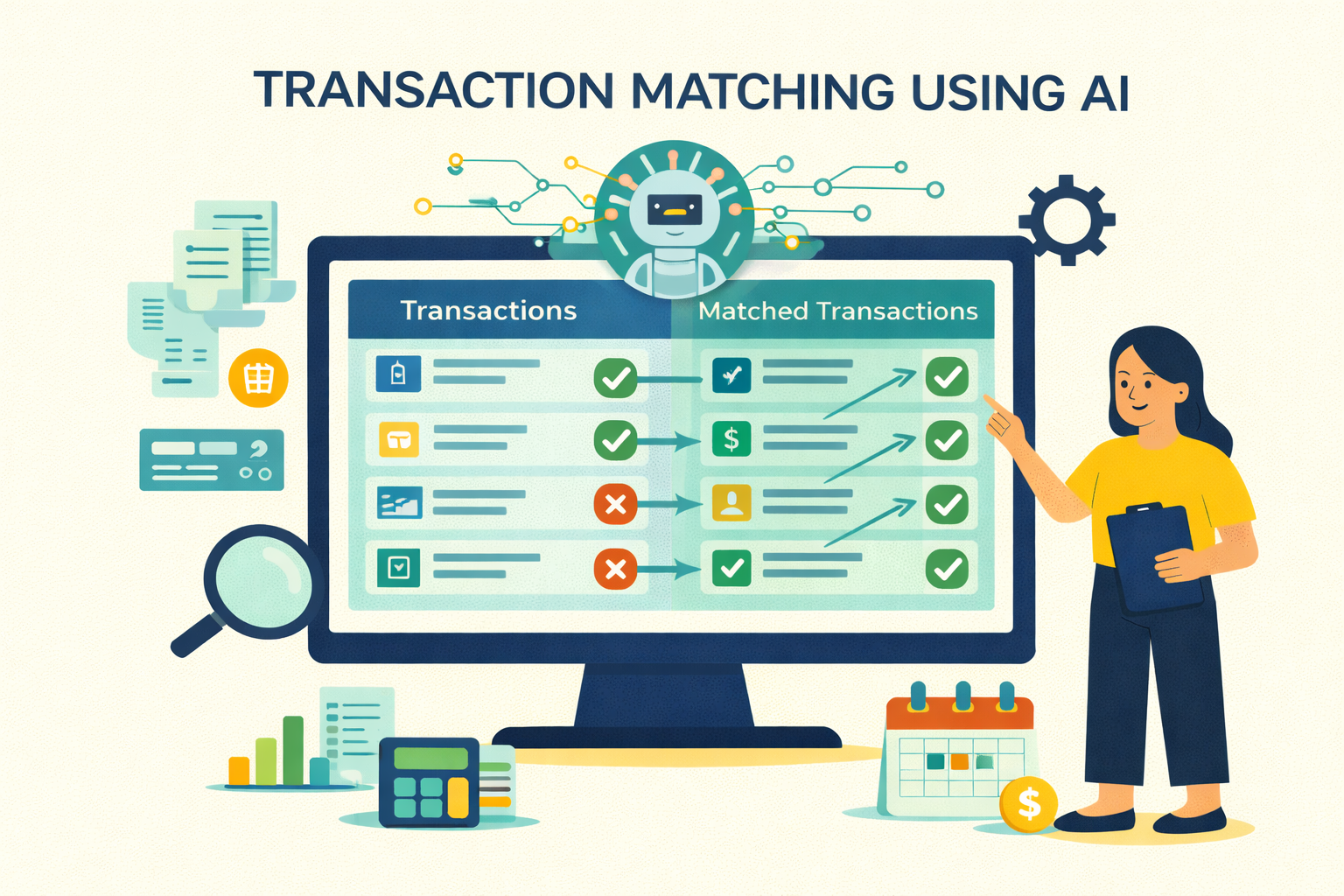

- Osfin uses logic-based transaction matching across bank statements, ledgers, ERPs, and clearing files, and auto-reconciles gateway data including taxes, fees, and settlements.

- It flags duplicates and anomalies as they come.

- Live dashboards offer real-time visibility into match status, exceptions, and exposure.

- Role-based access, end-to-end encryption, and 2FA guarantee maximum security.

- Osfin supports SOX controls and provides complete audit trails, meeting SOC 2, PCI DSS, ISO 27001, and GDPR standards.

- Custom rules, tolerances, and workflows can be set up with a no-code builder.

- Osfin is quick to deploy with minimal IT involvement, and backed by reconciliation and finance experts.

Whether you're preparing for your next audit or tightening your SOX internal controls, Osfin gives you the tools to future-proof your SOX compliance.

{{banner3}}

FAQs on SOX Control

1. What is a SOX control?

A SOX internal control ensures the accuracy, integrity, and reliability of financial reporting. It helps all public organizations prevent fraud, detect errors, and maintain compliance with regulations in the United States. At its core, the SOX control meaning directly ties in with corporate responsibility and transparency.

2. What are SOX IT controls?

SOX IT controls are specific to technological processes. They protect systems involved in financial reporting. As discussed, examples include user access management, system change controls, and data integrity mechanisms, all of which ensure that financial data remains accurate, secure, and compliant with SOX requirements.

3. Why are SOX controls important?

What makes SOX controls important is their objective to increase transparency in financial reporting. They reduce the risk of fraud, ensure data accuracy, and help organizations meet legal obligations under the Sarbanes-Oxley Act. Effective SOX control management and implementation is proportional to strong investor confidence and reputation.

4. How is SOX control testing done?

SOX control testing evaluates whether your controls are effectively designed and consistently operating. SOX controls examples in testing are walkthroughs, documentation reviews, sampling transactions, and testing control activities to ensure they are actually dealing with financial reporting risks as intended. Compliance with audit and regulatory standards is the other objective.

5. How long does SOX compliance take to implement?

It usually takes a year or one and a half years to implement SOX. However, companies should aim for 18 months to bake some wiggle room for human errors and unforeseen events in the plan. Especially if you’re preparing for an IPO, you should take that extra time to verify everything, and utilize the runway to define scope, document controls, test them, fix gaps, and re-test until everything holds up.

6. How much does SOX compliance cost?

Costs vary, but most companies spend anywhere from around $180K a year for smaller public entities to $2M+ for larger or more complex operations. The biggest drivers are audit fees, headcount, and the tools you use to manage testing and documentation.

7. Which teams should be involved in SOX testing?

Finance owns the numbers, internal audit or compliance manages the testing, IT or InfoSec supports access and system controls, and control owners in each business unit validate daily operations. When those groups stay aligned, SOX testing moves smoother and faster.

8. Cloud vs on-prem for SOX evidence storage?

Both work fine for compliance as long as you can prove evidence is complete, secure, and retained for seven years. Cloud is faster to deploy and makes collaboration easier for finance and audit teams. On-prem gives you more control over data location and security. The best choice is whichever helps you show clean, traceable evidence with the least friction.

9. Can automation replace auditors?

Not really. Automation can collect evidence, run repeatable tests, and save tons of manual work, but it can’t replace auditor judgment. Think of it as your way to make SOX faster, cleaner, and cheaper, while letting auditors focus on the calls that actually need human eyes.