Best General Ledger Softwares 2026: Comparison, Features & Reviews

TL;DR

General ledger (GL) software is basically the home base for a finance team’s numbers. It’s where transactions are recorded and where reports like balance sheets, income statements, and cash flow come from. Today, teams commonly use tools like NetSuite, SAP, Oracle, Microsoft Dynamics 365, Sage Intacct, Workday, QuickBooks, Xero, and Acumatica.

Bigger companies usually choose platforms like NetSuite, SAP, Oracle, or Workday because they can handle complexity, multiple entities, and stricter controls. Mid-sized teams often lean toward Sage Intacct or Dynamics 365 for their flexibility, while smaller businesses stick with QuickBooks or Xero because they’re easier to manage. As transaction volumes grow, many teams add tools like Osfin alongside their GL to handle reconciliations and exceptions without turning close into a fire drill.

At the end of the day, the best GL is the one that fits how your team works and saves you from fixing the same issues month after month.

How We Select and Review General Ledger Software

To build our list of the best general ledger software, we look at how finance teams actually use these systems during month-end close, reporting, and audits not just how they’re positioned in demos or sales material.

Our evaluation starts with core GL capabilities. This includes journal entry management, chart of accounts flexibility, multi-entity and multi-currency support, financial reporting, and how well the system supports close activities. We also pay close attention to how easily the GL works with reconciliation processes, since that’s where many teams still spend the most time manually.

Beyond features, we assess usability and implementation effort. Tools that finance teams can adopt quickly, configure without constant IT involvement, and maintain without heavy workarounds score higher. Integration depth is another key factor especially connections with banks, payment systems, billing tools, payroll, and reconciliation platforms.

We also review verified feedback from G2 and Capterra to understand real-world adoption, support quality, and long-term satisfaction. Platforms that consistently help teams reduce spreadsheet dependency, close faster, and stay audit-ready stand out in our analysis.

How We Score General Ledger Platforms

To keep comparisons consistent, every GL platform is evaluated using the same scorecard. Each tool is rated on a 1–5 scale across the following areas:

Core GL functionality & reporting (30%)

How well the system handles journals, chart of accounts, financial statements, and multi-entity reporting without manual workarounds.

Close readiness & reconciliation support (25%)

How easily teams can reconcile balances, track issues, support audits, and stay on schedule during close.

Integrations & time to value (20%)

Depth of integrations with ERPs, banks, billing, payroll, and reconciliation tools, plus how quickly teams can realistically go live.

Scalability & compliance (15%)

Ability to support growth, complex structures, and regulatory requirements as the business evolves.

Usability & customer feedback (10%)

Day-to-day ease of use for finance teams, backed by real customer reviews and adoption patterns.

This scorecard helps explain why certain general ledger sol rank higher than others and makes it easier to see which tools fit your company size, transaction volume, and operating model.

Which General Ledger Software Is Best for Your Use Case?

Not every general ledger system works the same way for every business. Some are built for large, complex organizations with multiple entities and strict controls, while others focus on simplicity, speed, or ease of day-to-day use.

Here’s a quick way to narrow down your options:

- Best for large, multi-entity enterprises – SAP S/4HANA, Oracle Financials

- Best for cloud-first ERP and finance teams – NetSuite, Workday Financial Management

- Best for mid-market teams needing flexibility and reporting – Sage Intacct, Microsoft Dynamics 365

- Best for small and growing businesses – QuickBooks, Xero

- Best for automating GL reconciliation at scale – Osfin (used alongside your existing GL)

The right general ledger depends on how complex your structure is, how much reporting and compliance you need, and how much manual reconciliation your team still does today. As transaction volumes grow, many teams keep their GL as the system of record and add tools like Osfin to reduce spreadsheet work, handle exceptions, and keep close moving smoothly.

This article explores the 10 best general ledger software solutions in 2026, their key features, and how to choose the right one for your business.

We will also highlight how platforms like Osfin are completely simplifying general ledger management operations through automation. Let’s get started.

What Is General Ledger Software?

The general ledger for your business is essentially a repository of all your financial transactions. A general ledger software is a financial management system that records, categorizes, and consolidates all such financial transactions. It serves as the single source of truth, letting your teams generate accurate balance sheets, income statements, and cash flow statements.

Manual record keeping has always been in practice, so why do you need software? Modern general ledger software can go far beyond manual record keeping and error prone matching. It can completely cut down human errors, simplify your financial transaction management, and keep you prepped for all audit and compliance processes. It can also integrate with ERP, banking, and reconciliation systems to provide real-time insights, and maintain all your information in a single platform.

Having established the foundation of what this software is, let us now look at the essential features that you ought to look for when considering general ledger software.

.avif)

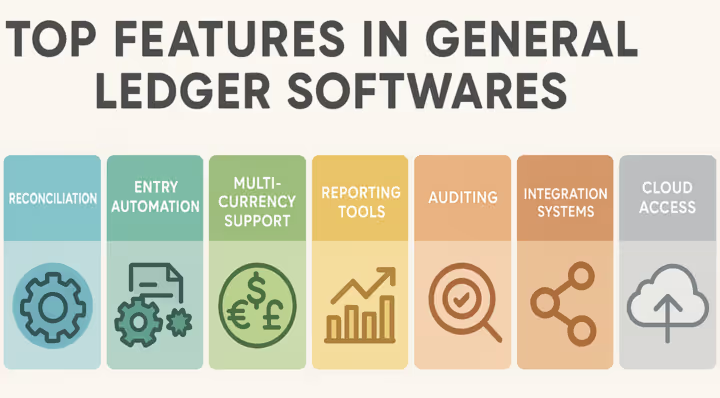

Key Features of the Best General Ledger Software

When evaluating general ledger solutions, you will need to look at a couple of key features to determine the right fit. We’ve made a checklist to simplify the process:

1. Double-Entry Accounting System

This is the foundation of any good general ledger management and reconciliation software. An ideal system should use a double-entry accounting framework that records each transaction as both a debit and a credit. The end goal here is ensuring balanced books and reducing errors.

2. Automation

Next, the system should provide automated workflows for streamlining repetitive tasks. This feature is critical for minimizing manual effort.

3. Multi-Currency Support

For businesses with global operations, this multi-currency support is a must. It allows international financial operations with confidence.

4. Financial Reporting Tools

Importantly, an ideal platform should generate real-time financial reports. These are ultimately things that inform decision-making. Creative and intuitive options like dashboards with financial insights can add a lot to the user experience.

5. Audit Trail

Compliance is an essential component of dealing with any form of financial data. The software should maintain a complete record of every transaction, approval, and change with timestamps and user identifiers. Without these, audit readiness is harder to ensure.

6. Integration with Other Systems

For frictionless operations, the ideal system should integrate seamlessly with a wide suite of softwares and tools(CRM, ERP, invoicing, payroll, banking, and tax tools). When financial data is connected, ensuring consistency is a lot easier.

7. Data Security

Lastly, the platform should provide strong encryption, role-based access, and backup protocols while supporting compliance with GAAP, IFRS, and other accounting standards.

With these features in mind, the next step is to explore the benefits that come from adopting the right general ledger software.

Benefits of Using General Ledger Software

Implementing general ledger software can have more significant advantages than apparent at first glance. The main benefits include:

.avif)

1. Accuracy and Error Reduction

This is the first and foremost benefit of using any software in your accounting processes. With the automated entries in a general ledger software, your business can minimize human errors, which often prove to be costly.

2. Time Efficiency

With the right general ledger software, repetitive tasks are eliminated, and reporting cycles become a lot faster. Time efficiency and its importance cannot be overstated when it comes to financial data and its reconciliation.

3. Real-Time Insights

Businesses gain up-to-date visibility into financial performance, enabling better decision-making. Instant dashboards and automated reconciliations help managers spot trends quickly.

4. Scalability

General ledger software is often suitable for startups and enterprises, with features that scale as operations expand. Different software tools have different scope in this regard, so make the choice carefully.

5. Improved Compliance

Audit trails and standardized reporting formats help businesses meet regulatory requirements. This ensures transparency and accountability.

6. Cost Savings

General ledger software reduces reliance on large manual accounting teams and prevents costly errors.

{{banner2.1}}

Comparison Table – General Ledger Accounting Software at Glance

To better understand how the top contenders compare, let us review them in a structured comparison table.

10 Best General Ledger Software for 2026

1. Osfin: Best for Automated General Ledger Reconciliation at Scale

Osfin is a reconciliation-focused finance platform built for teams handling large volumes of general ledger accounting data. It works alongside your existing GL or ERP system to automate matching, manage exceptions, and maintain audit-ready workflows without replacing what you already use.

It’s particularly useful for teams dealing with manual GL reconciliations, spreadsheet-heavy closes, or data coming in from multiple sources like banks, payment systems, ERPs, and internal ledgers.

Key Features

- Automated GL reconciliation

- One-to-one, one-to-many, and many-to-many matching

- Exception tracking with ownership and approvals

- ERP and accounting system integrations

- High-volume transaction processing

- Finance-led, low-code rule configuration

- SOC 2, GDPR, role-based access, and audit logs

Pros & Cons

Pros

- Reduces manual GL reconciliation work at scale

- Handles high transaction volumes where spreadsheets fall short

- Easy for finance teams to configure without heavy IT support

- Clear visibility into exceptions with built-in audit trails

- Works with existing GL and ERP systems

Cons

- Not a standalone general ledger or ERP

- May be more than needed for very simple reconciliation setups

How It Helps Finance Teams

Automated Matching

Osfin matches GL balances and transactions across systems using configurable rules, cutting down manual comparisons.

Exception Handling

Unmatched items are flagged in one place, making it easier to assign, investigate, and resolve issues.

Flexible Setup

Finance teams can update rules and workflows themselves as volumes or processes change.

What Users Say

Teams often mention how much time Osfin saves during close by reducing spreadsheet work and manual checks. Many also value that it fits into their existing accounting stack, helping them scale reconciliation without changing core systems.

Bottom Line

Osfin is a good fit for teams that already have a general ledger in place but need a better way to reconcile data accurately and efficiently. For organizations managing high volumes, multiple data sources, and tight close timelines, it helps turn GL reconciliation into a faster, more controlled process.

2. Wave

Wave is a free, top-rated accounting software tailored for freelancers and small businesses. It is considered the best option for automating repetitive tasks like bookkeeping, invoice and financial report creating.

Bookkeeping, tax preparation, and payroll teams will find Wave most suitable for their general ledger management needs.

Pros:

- Comprehensive accounting for smaller businesses

- Effective expense tracking

Cons:

- Slow performance speeds

- Unreliable bank account reconciliation

3. Odoo

Odoo is an open-source platform that consolidates multiple functions in a single and modular platform. Odoo is best for admin and entrepreneurial teams with accounting needs.

Pros:

- Highly customizable

- All-in-one platform

Cons:

- Technical setup

- Slow support

4. Zoho Invoice

Zoho Invoice focuses on invoicing, accounting, billing while also providing general ledger features. It is considered to be an excellent general ledger management software, and is a lot more cost-effective for a lot more features.

Pros:

- Cost-effective

- Multiple payment integrations

Cons:

- Poorer support options

5. Zoho Books

Another option offered by Zoho is Zoho Books. All online, it offers a complete accounting suite for all businesses. It integrates with other Zoho services in addition to external payment platforms. Using Zoho Books provides you with features like invoicing options, payment management, and billing.

Pros:

- Automated invoicing

- Multi-currency support

Cons:

- Pricing is worse for scaling businesses

- Advanced features are paywalled

6. Agiled

One of the most popularly sought-after general ledger software is Agiled.

Agiled combines every business management need: CRM, project management, documentation and financial processes. Customer service, admin, consulting, and engineering domains find frequent use of Agiled in their operations. Agiled can significantly simplify your general ledger reconciliation and management workflows, with its wide suite of features.

Pros:

- Integrated management capabilities

- Customizable client portals and task management

Cons:

- Limited payment options(region/payment provider specific)

7. TallyPrime

TallyPrime is a popular choice among Indian businesses, within finance, accounting, and admin domains. It has become a household name for accounting operations. TallyPrime includes advanced accounting features, financial reporting, inventory management, and ledger management features.

Pros:

- User-friendly interface

- Prompt, accurate reporting features

- Extensive data management

Cons:

- Customization is complex

- No cloud synchronization

8. FreeAgent

FreeAgent is designed for freelancers and SMEs as well.

It automates tax estimates, expense tracking, and general ledger updates, along with comprehensive accounting and invoicing management capabilities. Of particular note are the features to schedule recurring invoices, and ease of use for even non-accountants.

Pros:

- Quick, effective support

- Time-saving invoicing management features

Cons:

- Lack of automation

- Slow updates

9. ZipBooks

ZipBooks is an online cloud-based accounting solution. It offers a clean interface, a notable free plan, and useful features like recurring invoices, time tracking, and financial reporting, and even a competitor comparison within the platform. Small businesses will find maximum compatibility with ZipBooks.

Pros:

- Affordable GL software option

- Integration capabilities

Cons:

- Limited advanced features

- Platform limitations

10. TopNotepad

TopNotepad is a general ledger and accounting software that meets your billing, expense tracking, tax management and client management needs. This is a great option for those in freelancing, consulting, and IT industries

Pros:

- Ease of use

- Invoicing and VAT features

Cons:

- Limited customization

How does Osfin Enhance General Ledger Operations?

Osfin brings automation and accuracy to general ledger management and reconciliation by offering real-time reconciliation, automated workflows plus error detection, and seamless integration with popular accounting and payment systems. Because of its focus on automation-first workflows, Osfin is a popular choice in the reconciliation and accounting domains.

Here are the key features of Osfin:

Smart Transaction Matching & Reconciliation

- Automated matching for partial, multi-source, and transaction-level reconciliation across ledgers, bank statements, ERPs, and clearing files

- Automated reconciliation of payment gateway reports, including handling of fees, taxes, and settlements

- Intelligent duplicate detection, anomaly spotting, and real-time exception tagging with smart routing to teams

Flexible Data Integestion & Format Support

- Compatible with all major file formats: MT940, ISO 20022, CSV, JSON, and XML

- 170+ prebuilt connectors for ERPs, core banking systems, processors, and APIs

Customizable & User-Friendly Workflows

- No-code rule builder to define custom tolerances and workflows

- Real-time dashboards to track exceptions, exposures, and match status

Security, Compliance & Auditability

- Enterprise-grade security with end-to-end encryption, role-based access, and two-factor authentication

- Audit-ready workflows with complete transaction traceability

- Compliance aligned with SOC 2, PCI DSS, ISO 27001, and GDPR standards

Deployment & Expert Support

- Rapid and easy deployment process that will require minimal IT resources

- Continuous support from reconciliation and finance operations specialists

{{banner3.1}}

How to Choose the Right General Ledger Software?

With these many software options on the market, making the right choice can feel daunting. Here, we will walk you through a couple of factors to consider when choosing the right general ledger software:

1. What is your business size?

General ledger software is often tailored towards certain business types and sizes. Freelancers may prefer free tools like Wave or Manager, while larger firms may need ERP-integrated platforms like Odoo or Versa for their general ledger management and reconciliation needs.

2. What are your compliance needs?

If you’re working in a tightly regulated industry, consider GL software with compliance and regulatory support. For example, some organizations use TallyPrime and Busy due to GST compliance features.

3. What integrations do you need?

Whatever existing CRM or ERP systems are in place in your business, the right GL software will need to provide sufficient integration options, to improve your data consolidation and accuracy. Ensure that the software integrates with existing invoicing, payroll, or CRM systems.

4. What is your budget?

There are multiple pricing options and plans available when it comes to any GL software – make sure that your top pick fits well within your budget. Free or low-cost solutions may suffice for startups, while enterprises can consider heavier investments in scalable systems.

5. How scalable does the software need to be?

Choose a system that grows with your business. As your business expands, the number of integrations increase, and financial data overflows, you will need a reliable partner in your GL software that scales with you.

In addition to these, consider the data security measures that the chosen platform provides, the extent of customer support, the existence of a large user base and forums, reporting features, and ease-of-use. Consider all these factors in tandem – they will make a large impact on your operational efficiency going forward!

{{banner.1}}

Future Trends in General Ledger Software for 2026 and Beyond

The general ledger software market is not stationary. New innovations are constantly being released to match the demands of the businesses and freelancers using them. Some of the most important trends include:

1. Advanced Automation

Advanced algorithms and automation are soon to become commonplace (vis-a-vis anomaly detection, predictive analytics, and smart reconciliation). Tools like Osfin are already ahead of the curve when it comes to this. AI and ML-based tools are likely to see expansive growth in the future.

2. Blockchain Integration

Blockchain is another tech buzzword that represents a database with advanced data storage capabilities. Blockchain’s distributed ledgers can provide transparent transaction records, with more roadblocks when it comes to data modification. When used in general ledger software, this can reduce the risk of fraud and simplify external audits.

3. Embedded Finance

The best general ledger softwares will be able to connect directly with payment, lending, and treasury services, going beyond the simple integrations of contemporary softwares.

4. Cloud-First Approach

Businesses of all sizes will migrate to cloud-native systems. These systems provide scalability with your financial data, convenient flexibility, and continuous updates. Some solutions on the market already position themselves as cloud-first.

5. Regulations and Compliance

Compliance requirements are evolving and expanding, quickly. General ledger management and reconciliation tools will soon deliver automatic policy updates and reporting frameworks to help companies stay audit-ready at all times.

.avif)

{{banner1.1}}

Powering the Future of Finance with Osfin and General Ledger Software

General ledger software in 2026 is equipped with powerful accounting and automation features. Currently, there exists a solution for every business type. The benefits of incorporating one for your general ledger management and reconciliation are immense and multifactorial, so it’s important to consider your requirements when making the choice.

Solutions like Osfin can take these benefits further with automated reconciliation, smart transaction matching, and real-time exception tagging that streamline ledger accuracy. With 170+ integrations, customizable no-code workflows, and audit-ready security, Osfin ensures financial transparency and compliance while reducing manual effort.

{{banner3}}

FAQs on General Ledger Softwares

1. What is the main purpose of general ledger software?

Utilizing a general ledger software in your workflow provides a single platform for managing all financial data from the general ledger. The range of features commonly provided by modern general ledger software supports transaction recording, invoice capture, financial reporting, as well as audit prep, with no room for manual errors.

2. Which general ledger software is best for freelancers?

Freelancers often need affordable, easy-to-use tools that do not require advanced accounting expertise. Software like Wave, FreeAgent, and Hurdlr are good choices here. The most important invoicing, expense tracking, and tax management features are all covered through them. Read through our guide for a clearer idea of their features and compatibility with your freelancing operations.

3. Is there free general ledger software available?

For each general ledger software, different pricing points, options, and plans are available. Wave, GnuCash, and Manager are popular choices, since they offer key functions without subscription fees.

4. How does general ledger software help with compliance?

Because general ledger software maintains audit trails, and generates standardized financial reports, compliance with financial regulations becomes easier. Some softwares can even provide timely updates for tax and accounting regulations.

5. Can general ledger software integrate with ERP systems?

Yes, many advanced platforms are designed with ERP integration capabilities. This is because businesses must unify their accounting with operations, inventory, HR, and CRM systems. The benefits are twofold: ensuring data consistency, and enhancing operational efficiency when it comes to general ledger management and reconciliation.